XRP slides 19% from January highs, pushing sentiment to 'extreme fear'

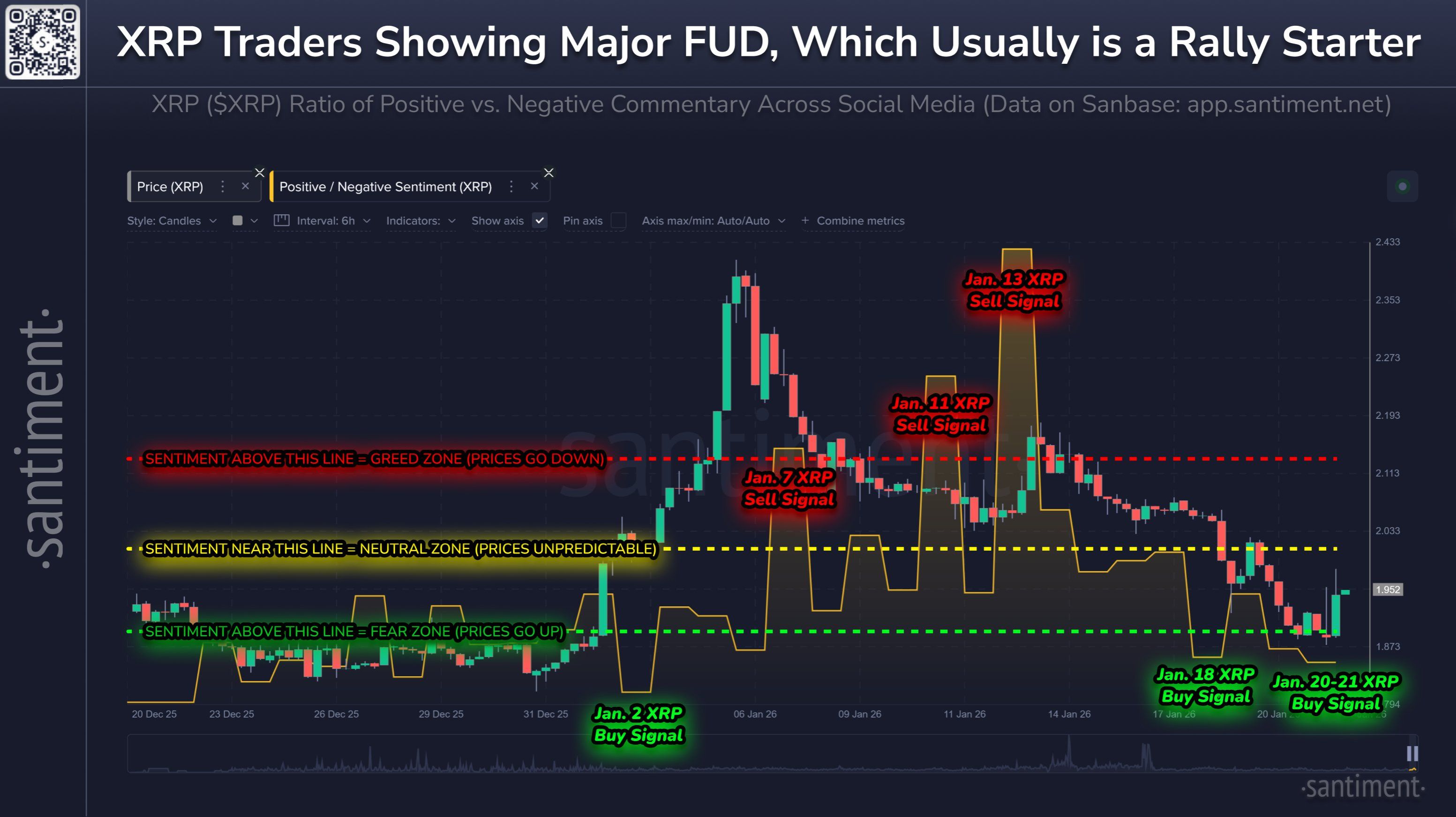

XRP is in Santiment’s “extreme fear” zone after the token fell roughly 19% from its Jan. 5 high, a sign online chatter has turned heavily bearish.

The pullback has left traders split between bracing for more downside and wondering whether the worst of the selling may already be behind it. Social feeds have grown increasingly negative, a shift that often shows up late in a move rather than at the start.

Santiment’s signal comes from social chatter rather than price. It tracks whether online discussion skews positive or negative across major platforms. When negativity dominates, it usually means smaller traders have grown cautious, stopped buying dips, or decided to step aside altogether.

That matters in crypto because positioning tends to get crowded quickly. When most traders lean the same way, markets can move sharply once selling pressure eases. Even modest buying can have an outsized impact as shorts cover positions and sidelined traders cautiously reenter.

At the same time, fear readings are not a timing tool. Negative sentiment can linger if the broader market remains unstable or if there is no clear catalyst to change the narrative. The data also does not explain why people turned pessimistic, only that they did.

However, recent onchain data suggests there may be more going on beneath the surface.

XRP’s holder structure is starting to resemble early 2022, as CoinDesk reported earlier this week, a period that ultimately preceded months of weakness. Newer buyers from the past one week to one month have been accumulating at prices below the cost basis of holders who bought six to twelve months ago.

A similar setup emerged in February 2022, when XRP traded near $0.78 before sliding for months and eventually reaching lows around $0.30 by mid year.

For now, the key is how price behaves next. If XRP stabilizes and begins reclaiming lost ground, the gloomy mood can flip quickly and help fuel the early stages of a rebound.

If weakness persists, the fear reading may simply be documenting a market that is still searching for firmer footing rather than signaling an imminent turn.